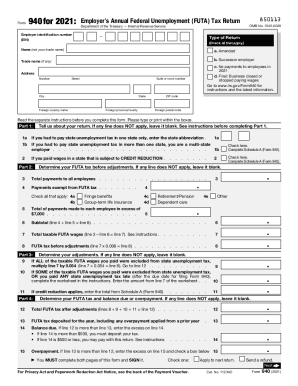

OH IT 941 free printable template

Show details

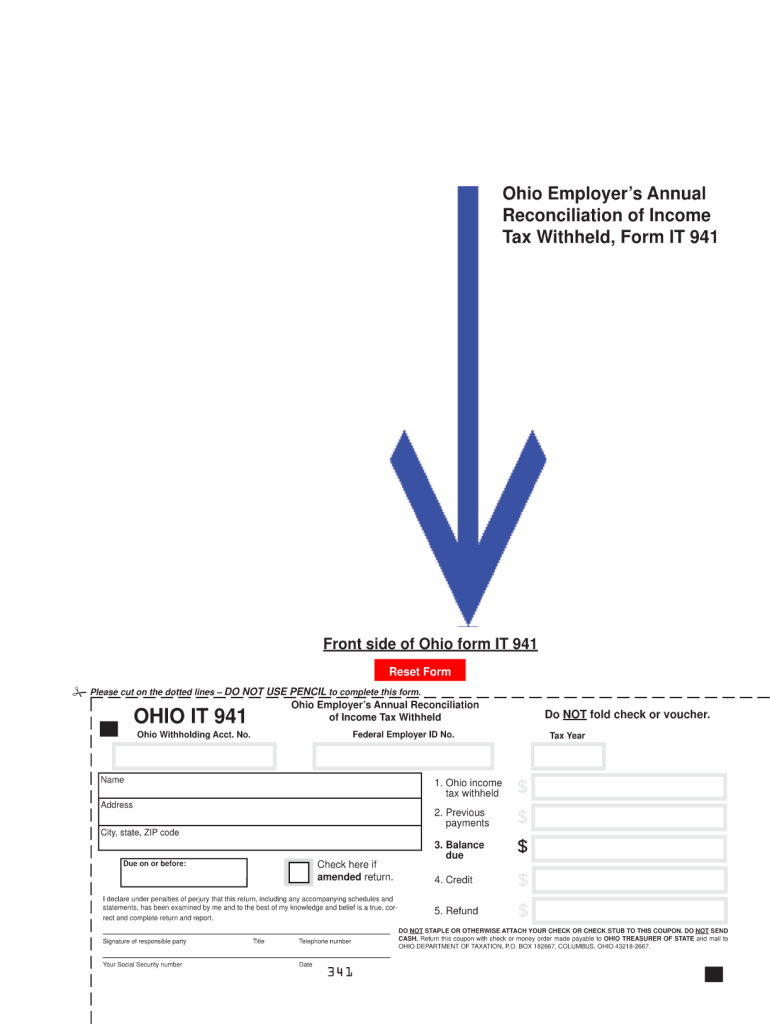

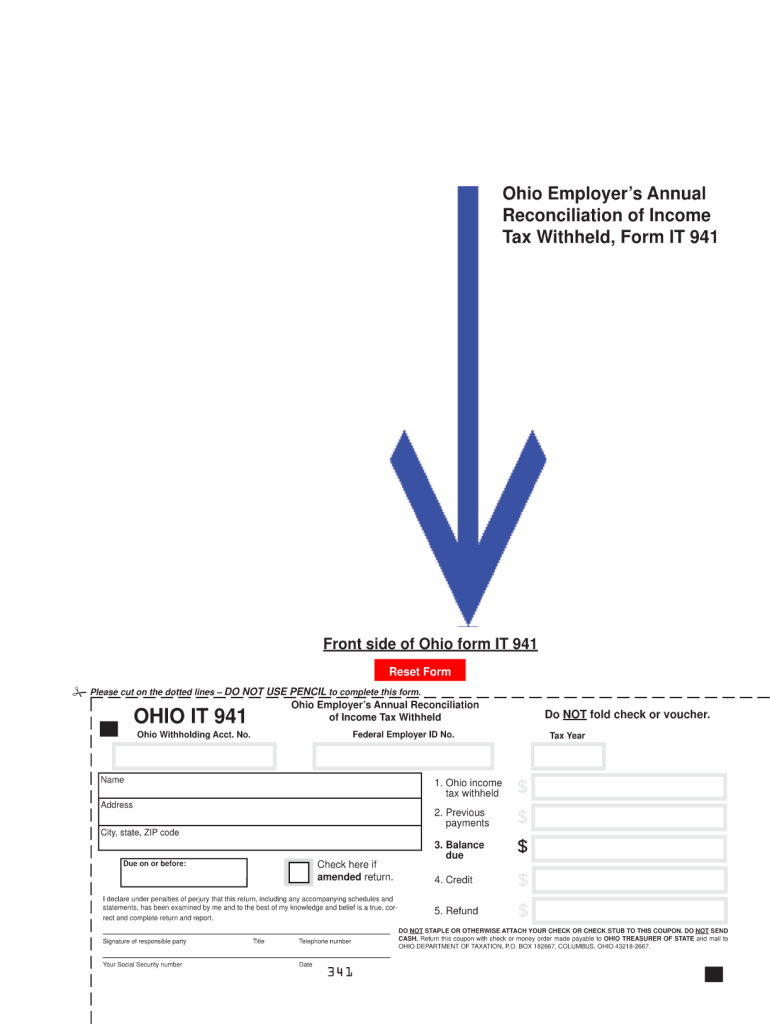

Ohio Employer's Annual Reconciliation of Income Tax Withheld, Form IT 941 Front side of Ohio form IT 941 Reset Form Please cut on the dotted lines DO NOT USE PENCIL to complete this form. OHIO IT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ohio it 941 form

Edit your ohio form it 941 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio income withholding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ohio it 941 form online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit state of ohio it 941 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ohio it 941 annual reconciliation form

How to fill out OH IT 941

01

Obtain the OH IT 941 form from the Ohio Department of Taxation website or request a paper form.

02

Begin by entering your business's legal name, trade name (if applicable), and address in the designated fields.

03

Provide your Federal Employer Identification Number (FEIN) and Ohio tax identification number.

04

Input the reporting period for which you are filing the tax, clearly stating the start and end dates.

05

List the total amount of wages paid to employees during the reporting period and calculate the taxable wages.

06

Complete the sections related to any adjustments, exemptions, or credits that may apply.

07

Calculate the total amount of tax due based on the taxable wages and applicable rates.

08

Review the form for accuracy, sign, and date it to certify the information provided.

09

Submit the completed form by mail or electronically according to the Ohio Department of Taxation guidelines, ensuring timely payment of any taxes due.

Who needs OH IT 941?

01

Employers in Ohio who pay wages to employees and are required to withhold and remit income tax to the state.

02

Businesses that have a tax obligation for employees and need to report their withholding to the Ohio Department of Taxation.

Fill

it 941

: Try Risk Free

People Also Ask about ohio it 941 annual reconciliation of income tax withheld

How much should I withhold for Ohio taxes?

The state of Ohio requires you to pay taxes if you're a resident or nonresident that receives income from an Ohio source. The 2021 state income tax rates range from 2.765% to 3.99%, and the sales tax rate is 5.75%.

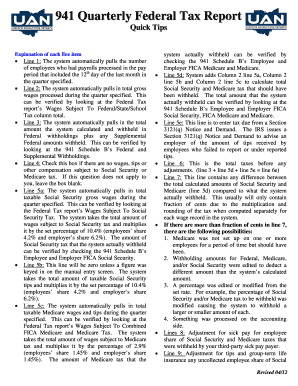

What tax percentage is withheld from paycheck in Ohio?

First of all, no matter what state you live in, your employer withholds 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes.Income Tax Brackets. All FilersOhio Taxable IncomeRate$0 - $25,0000.000%$25,000 - $44,2502.765%$44,250 - $88,4503.226%

Who is exempt from Ohio withholding?

The exemptions include: Reciprocity Exemption: If you are a resident of Indiana, Kentucky, Pennsylvania, Michigan or West Virginia and you work in Ohio, you do not owe Ohio income tax on your compensation. Instead, you should have your employer withhold income tax for your resident state. R.C. 5747.05(A)(2).

What does Ohio withholding mean?

With rare exception, employers that do business in Ohio are responsible for withholding Ohio individual income tax from their employees' pay. Ohio employers also have the responsibility to withhold school district income tax from the pay of employees who reside in a school district that has enacted such a tax.

What is Ohio employer withholding?

In this tax, both employees and employers have to pay a percentage of their wages which is currently set at 6.2%. It is applicable for a certain amount ing to the tax year. For the year 2022, in Ohio, have to contribute 147,000$ of the employee's annual earnings.

How do I set up tax withholding?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

How do I get a Ohio withholding ID number?

Ohio Withholding Account Number You can look this up online or on any previous Form IT-501. If you're unsure, contact the agency at 888-405-4039.

What is Ohio withholding?

The rate is at least 3.5% percent. Ohio Administrative Code 5703-7-10 provides that withholding agents must withhold at least 3.5% on supplemental compensation such as bonuses, commissions, and other nonrecurring types of payments other than salaries and wages.

What percentage should I withhold for Ohio State taxes?

The state of Ohio requires you to pay taxes if you're a resident or nonresident that receives income from an Ohio source. The 2021 state income tax rates range from 2.765% to 3.99%, and the sales tax rate is 5.75%.

How do I set up Ohio withholding?

Companies who pay employees in Ohio must register with the OH Department of Taxation for a Withholding Account Number and the OH Dept of Job and Family Services (ODJFS) for an Employer Account Number. Apply online at the Ohio Business Gateway to receive the number immediately upon completing the application.

Does Ohio have a withholding form?

Submit form IT 4 to your employer on or before the start date of employment so your employer will withhold and remit Ohio income tax from your compensation.

What percentage of your salary goes to taxes in Ohio?

2023 Ohio (OH) State Payroll Taxes Income tax rates range from 2.765% to 3.99% with varying tax brackets.

How is Ohio withholding calculated?

Withholding Formula (Effective Pay Period 19, 2021) Multiply the adjusted gross biweekly wages by the number of pay dates in the tax year to obtain the gross annual wages. Divide the annual Ohio income tax withholding by the number of pay dates in the tax year to determine the Pay Period gross tax amount.

What is the Ohio State withholding tax rate for 2022?

For taxable years beginning in 2022: Ohio Taxable IncomeTax Calculation0 - $26,0500.000%$26,051 - $46,100$360.69 + 2.765% of excess over $26,050$46,100- $92,150$915.07 + 3.226% of excess over $46,100$92,150 - $115,300$2,400.64 + 3.688% of excess over $92,1501 more row • May 6, 2020

How much should I withhold for for taxes in Ohio?

The rate is at least 3.5% percent. Ohio Administrative Code 5703-7-10 provides that withholding agents must withhold at least 3.5% on supplemental compensation such as bonuses, commissions, and other nonrecurring types of payments other than salaries and wages.

What is the withholding rate for Ohio?

Withholding Formula (Effective Pay Period 19, 2021) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $5,0000.5%Over $5,000 but not over $10,000$25.00 plus 1.0% of excess over $5,000Over $10,000 but not over $15,000$75.00 plus 2.0% of excess over $10,0005 more rows • Oct 4, 2021

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit state of ohio form it 4 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including ohio it 941 form pdf, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I fill out the it 941 ohio form on my smartphone?

Use the pdfFiller mobile app to complete and sign ohio withholding form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit tax ohio income on an Android device?

The pdfFiller app for Android allows you to edit PDF files like ohio withheld printable. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is OH IT 941?

OH IT 941 is the Ohio Employer's Withholding Tax Report, used by employers to report and remit withholding taxes from employee wages.

Who is required to file OH IT 941?

Employers who withhold income taxes from employee wages in Ohio are required to file OH IT 941.

How to fill out OH IT 941?

To fill out OH IT 941, employers must provide their business information, report total payroll amounts, calculate the withholding tax due, and sign the form before submitting it to the Ohio Department of Taxation.

What is the purpose of OH IT 941?

The purpose of OH IT 941 is to ensure that employers report the correct amount of state income tax withheld from employee wages and remit these funds to the state.

What information must be reported on OH IT 941?

Information required on OH IT 941 includes the employer's identification information, total taxable wages, total tax withheld for the reporting period, and any adjustments or payments made during the period.

Fill out your OH IT 941 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ohio It 941 Fill In is not the form you're looking for?Search for another form here.

Keywords relevant to tax ohio form

Related to pdffiller

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.